CRE PD-LGD Model

Loan Scoring - PD LGD Model (Stochastic Approach)

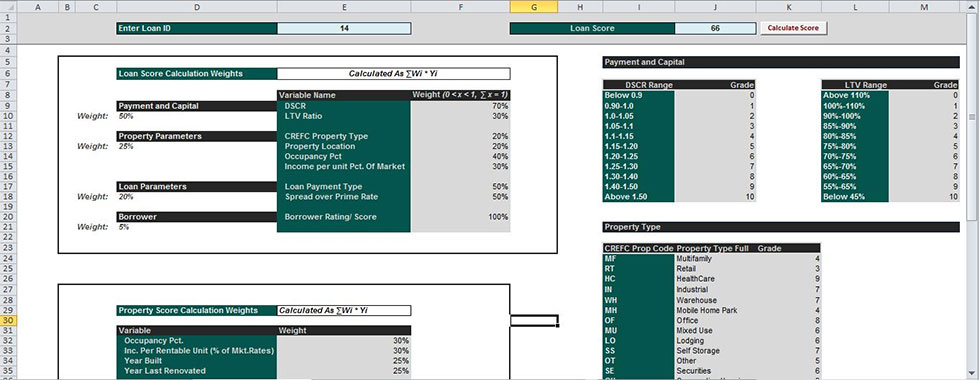

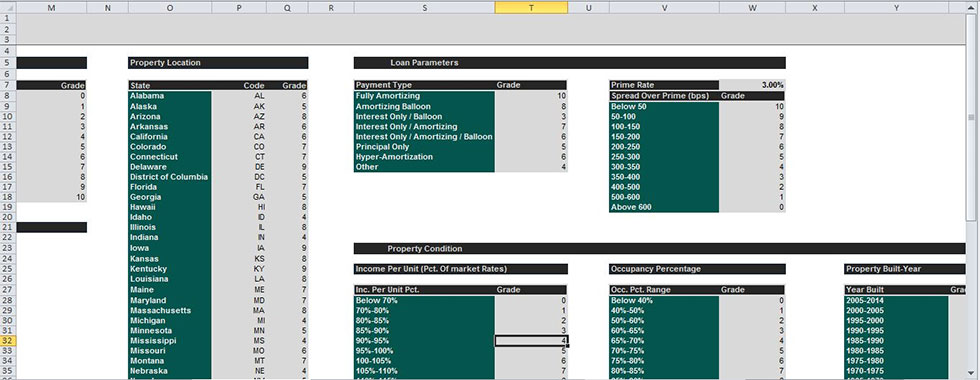

- Loan Score Based Default Vectors - Each commercial real estate loan and property is evaluated on multiple parent criteria like Payment and Capital, Property Parameters; each of which is assigned different user-defined weights. Each such category contains sub-categories with weight factors and is assigned scores on a scale of one to ten. The final weighted average loan score is used to pick a set of appropriate CPR and CDR rates which are used to generate stressed loan cash flow.

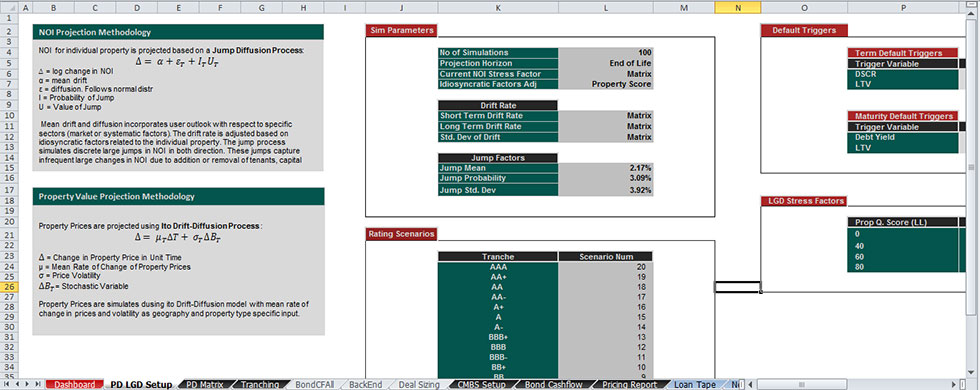

- Probability of Default (Stochastic PD-LGD model) - This method uses a stochastic Jump-Diffusion Process to project the future path of property Net Operating Income (NOI). The drift rate takes into account systematic factors like sector outlook for short and long-term rental growth rates, average income volatility and is an input based on property type and geography. The drift rate and volatility is further adjusted to integrate the effects of idiosyncratic factors like property specific occupancy rates, income per unit (compared to market average), build and renovation years. The jump process introduces infrequent jumps of much larger magnitude in the projected NOI path and mimics sudden rise or drop in income due to changes in property vacancy, capital expenditures etc.

- Default Triggers - DSCR and LTV are used in conjunction as the trigger variables. LTV is calculated based on simulated property prices using Ito drift-diffusion stochastic process. The loan is defined to enter into a state of default if both DSCR and LTV ratios drop below their threshold N number of times in an interval of X periods.

- Loss Given Default - Loss is calculated as outstanding loan balance at default less the simulated appraised property value. The loss rate is further stressed based on loan size and property quality score. An average LGD percentage is calculated for all simulation runs leading up to a default.

- Expected Loss - Finally, expected loan loss is calculated for each loan using the results of n simulations to predict PD and LGD. The expected loss (EL) is calculated as a PD x LGD for each loan.

Model Screenshots

Get in touch: contact@integrand.in | Request Demo